If you qualify as a head of household filer, your 2020 tax rate will be lower. If the qualifying person you’re claiming is a dependent parent, however, the person doesn’t have to live with you for you to file head of household. You paid more than half the cost of keeping up a home for the year.Ī qualifying person lived with you for more than half the year. You’re unmarried or considered unmarried on the last day of the year. You could qualify to file as head of household if you meet all of the following requirements: Who Qualifies as Head of Household When Filing Taxes? Read Next: Every Tax-Filing Status Explained The tax brackets for married filing jointly and qualifying widow/widower are identical, so some consolidate the five filing statuses into four.

Individual taxpayers - also known as single filing status for Form 1040 The category you fall under will be an indicator of which 2020 tax forms you’ll need to fill out, and what tax bracket applies to your situation: Virtually all Americans - those not filing as a trust or estate - fall into one of five tax filing categories. What Are the Different Tax Filing Categories? Brackets range from those who made no income at all to the wealthiest individuals - in the highest federal tax rate bracket - who earn $622,051 or more in a tax year. How Many Federal Tax Brackets Are There?Įach individual filing category contains seven income-based 2020 federal tax brackets.

MARRIED FILING JOINTLY TAX BRACKETS 2021 PLUS

For example, head of household filers who earn between $85,501 and $163,300 will pay $13,158 plus 24% of any amount over $85,501. Those who fall into the remaining brackets pay a flat rate that’s applicable to everyone in the bracket and then a percentage of the income they earn over the bracket’s minimum.

Taxpayers in the first bracket, who earn the least income, pay a flat rate of 10% in every filing category. How Is the Marginal Tax Rate Determined for Different Incomes in the Same Bracket?

:max_bytes(150000):strip_icc()/TaxRates-marriedfilingseparately2-c08c527d8c98486d800ae561f3012d66.jpg)

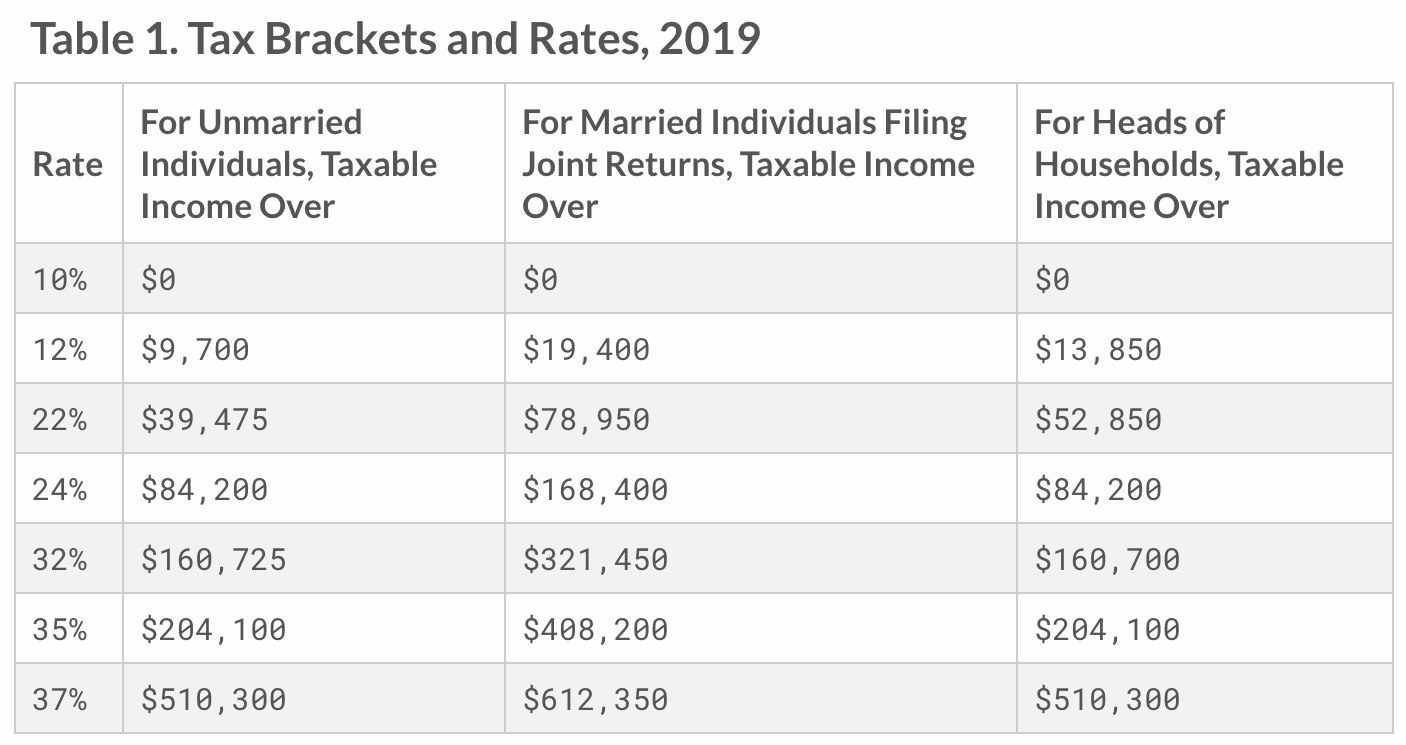

See: These Are the Receipts To Keep for Doing Your Taxes That gets added to $167,307.50, so the total taxes owed by this couple would be $196,149. However, this tax rate only applies to any income over $622,050, and that amount gets added to $167,307.50 - the sum of the graduated taxes paid on incomes up to $622,050. This status puts them in the highest tax bracket, which is taxed at a rate of 37%. To understand how tax brackets work, take the example of a married couple filing jointly whose taxable annual income is $700,000. uses a graduated tax system, which means that taxpayers pay an increasing rate as their income rises. However, it’s important to understand that your entire income is not taxed at your tax bracket rate. IRS tax brackets are divided based on your taxable income level, with different amounts taxed at different federal income tax rates.įederal income tax brackets are determined by income and filing status. uses the 2020 federal income tax brackets to determine how much money you’ll owe the IRS or how much of a federal income tax refund you will receive. Related: 10 Tax Loopholes That Could Save You Thousands Married Filing Jointly or Qualifying Widow(er) To help you quickly figure out which IRS income tax bracket you’re in, check the IRS federal tax table for 2020:įederal Tax Brackets 2021 for Income Taxes Filed by April 15, 2022 Your federal income tax bracket is based on your tax filing status and your income. What’s the Difference Between Married Filing Separately and Married Filing Jointly? When Should Married Couples File Separately? When Is It Better For Married Couples To File Jointly? What Are the Most Recent Changes to the Federal Bracket System?Ĭan I Deduct My Way Down to a Lower Tax Bracket?ĭoes Every State Use the Same Tax Bracket System? Who Qualifies as Head of Household When Filing Taxes?Īre There Ways To Lower Taxable Income Other Than Deductions? How Is The Marginal Tax Rate Determined for Different Incomes in the Same Bracket? Here’s an overview of what you’ll find in this guide to IRS tax brackets:

MARRIED FILING JOINTLY TAX BRACKETS 2021 PROFESSIONAL

If you’re uncertain about anything, ask for advice from a professional and use an income tax calculator.īe Prepared: All the New Numbers You Need To Know for Planning Ahead on Taxes

From there, do everything possible to reduce your taxable income - without concealing income, of course. The first step to surviving tax season is to know which bracket you fall into and which category you’ll file under. Your 2020 tax bracket and federal tax rate are both crucial pieces of information if you want to keep as much of your money as possible.

0 kommentar(er)

0 kommentar(er)